The electric vehicle revolution will come from China, not the US

The electric vehicle revolution is coming, but it won't be driven by the U.S. Instead, China will be at the forefront.

My research on EVs, dating back a decade, convinces me that this global transformation in mobility, from petroleum-fueled vehicles to electric ones, will come sooner than later. The shift is already happening in China, which is the world's largest automobile market, with . As Western countries approach peak car ownership, there are still hundreds of millions of Chinese families that – much less two or more.

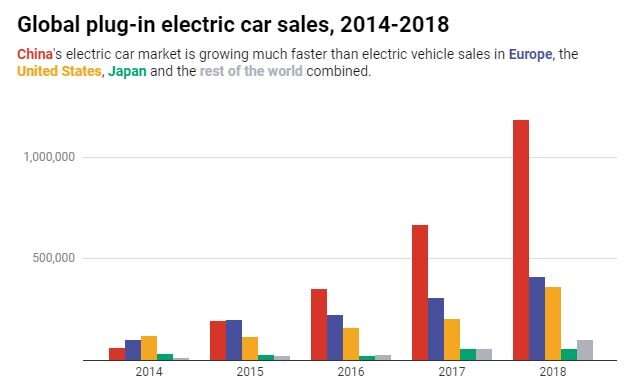

Many of them are buying electric cars. By 2015, electric vehicle sales in China had . In 2018, , more than 55% of all electric vehicles sold in the world, and more than as Chinese customers had bought two years earlier. U.S. electric vehicle sales that year were just 358,000.

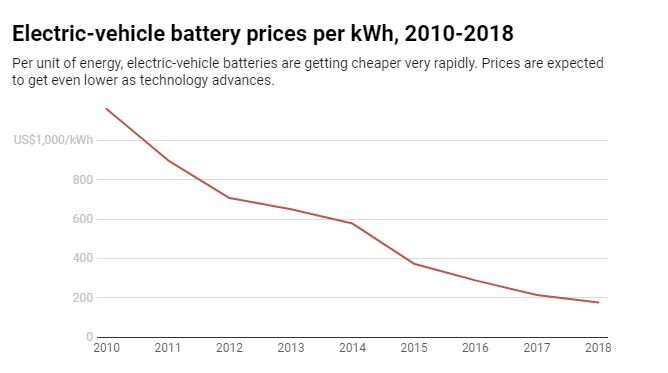

A key element of an electric vehicle's price is the cost of its batteries – and China already of the world's electric vehicle batteries. Battery prices continue to fall; industry analysts now suggest that to buy an electric car than a gas- or diesel-powered one.

Forecasts predict the Chinese producing by 2021, even as the demand for electric car batteries grows.

Huge government backing

China has a , automobile industry. It has never been able to of established automakers at making gas-powered vehicles, but electric vehicles are , giving Chinese firms a new opportunity to compete.

The Chinese government, therefore, has chosen to highlight electric vehicles as one of 10 commercial sectors central to its "" effort to boost advanced industrial technology. Government efforts include using manufacturing of electric vehicles and batteries, and encouraging businesses and consumers to buy them.

The government is also aware that electric vehicles could help solve some of : Massive air pollution chokes its major cities, national security officials are worried about how much oil the country imports and China is now the nation contributing most to global climate change emissions.

New companies

have formed to profit from these subsidies. A major player is BYD, which stands for "Build Your Dreams," headquartered in Shenzhen. More than a decade ago, billionaire investor Warren Buffett bought about – a share that is now worth more than $1.5 billion.

The company's initial plans to export vehicles to the U.S. proved premature and fizzled. BYD instead started to focus mainly on the Chinese auto market, as well as building , which it now dominates.

If BYD's electric car plans falter, though, there are plenty of other Chinese firms ready to pick up the slack.

Further support

In addition to the government subsidies to ensure BYD and its competitors have lots of customers, new government regulations are kicking in. The Chinese government now requires all automakers who sell in China, whether domestic or foreign firms, to make a certain percentage of their sales electric, through a complex crediting formula. The mandate will get stricter over time, perhaps requiring each company to make .

Major foreign car companies have and can hardly afford to abandon the market. Volkswagen, for example, now in China, which is a main reason the company is .

China's domestic automakers have largely not yet engaged in the export market. Electric vehicle industry analyst Jose Pontes says there are : First, the Chinese market is big enough to absorb their current production. Second, many car companies in China are utterly unknown in the West, so customers would be wary of buying from a strange brand. And third, their cars do not yet comply with strict safety regulations in the U.S. and Europe.

However, all of those obstacles can be overcome with time and money. It's possible Chinese electric car companies could enter the low- to middle-income market in the West, as .

If – or when – that happens, inexpensive, efficient electric cars may spread through the West from China, surpassing Tesla and other American and European electric vehicle efforts. Only Western government attempts to protect domestic automakers with tariffs and other trade barriers could derail this development.

Provided by The Conversation

This article is republished from under a Creative Commons license. Read the .![]()